TrustBank Wheaton

212 S. West St.

Wheaton, IL 60187

331.806.3163

Mark Spehr, Market President

Dan Doremus, Assistant Vice President

Jill Mason, VP/Business Development

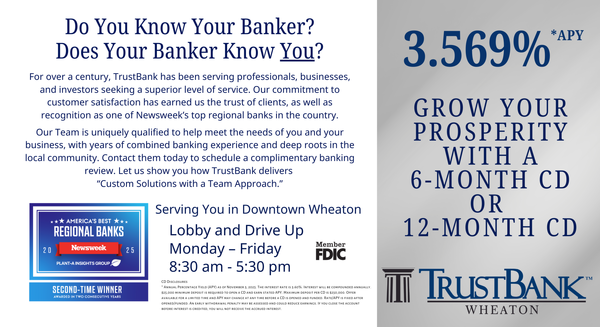

Do you know your banker? Does your banker know YOU?

For over 110 years, TrustBank has stood strong through the ups and downs. With our customers as our focus, we grow our prosperity together - leading with integrity, innovation, and exceptional performance. We strive every day to provide premier financial solutions with superior customer service.